{Reading Time: 6 minutes}

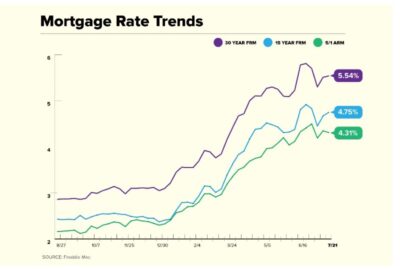

If you’re making a real estate move, it’s on your mind — this year’s sky-rocketing mortgage rates. Purchasing power has decreased, and many Buyers have been forced to delay or cancel their purchases.

The most intense Seller’s market in decades is slowing down.

Alongside recession and inflation concerns, the issue has triggered a flurry of questions from real estate Buyers and Sellers. Will interest rates keep going up? Will housing prices decrease? Should Buyers and Sellers put their plans on hold?

Economists across the country have weighed in on the subject. Following is a summary of various interviews with Forbes, Trading Economics, Redfin, US News & World Report, and others.

Q: In June 2022, the Fed initiated the biggest interest rate hike in almost 30 years in an effort to combat inflation. In the waning days of July, rates went up again. If/when the Fed continues to raise interest rates, will mortgage rates go up?

The short answer: Probably not.

Here’s why:

While most economists expect the Fed to raise interest rates still again later this year, mortgage rates will probably remain steady. The increase in mortgage rates has already happened — the current 6% already accounts for future interest-rate conditions.

That being said, if inflation remains high or another economic factor initiates an aggressive response from the Fed, we could get higher-than-expected mortgage rates.

Q: If we have a recession, will it impact the housing market?

The short answer: Unlikely.

Here’s why:

Despite the increased possibility for a recession in late 2022/early 2023, the housing market should remain resilient because property is a less risky, more stable investment than other assets. Additionally, the market has passed the peak-pricing phase. Although some homes are slightly less valuable than they were earlier this year, they’re still more valuable than they were three years ago.

Unemployment is usually the greatest factor in how the market responds to recession. Even if we see a slight uptick in unemployment, individual bank accounts and businesses would remain stable in a mild recession, which is what it looks like we’re facing. We do not expect to see a surge of desperate Homeowners forced to sell their homes.

Q: What’s going to happen to home prices?

The short answer: They’ll drop, but not by much.

Here’s why:

The worst-case scenario isn’t the most likely scenario. While the price of homes will drop in response to even a mild recession, they won’t fall to pre-pandemic levels, particularly in places where cost of living is more affordable. Big-boom areas, like major metropolitan hubs, will see larger declines congruent with stock market instability. While this is big-picture, Homeowners, Buyers, and Sellers only need to be concerned with the fluctuations in their immediate neighborhoods and cities.

Additionally, it’s helpful to note that home values typically rise over time so, even if a home is worth slightly less than it was a few months ago, this doesn’t reflect a long-term impact.

Q: Will the growing expense of home ownership impact migration patterns?

The short answer: Migration should slow down.

Here’s why:

In the first half of 2022, a significant number of home buyers moved from expensive cities to more affordable ones, largely due to pandemic-driven remote work becoming permanent. However, increases in mortgage rates often delay relocation plans, especially for Homeowners who currently have lower mortgage rates. Nonetheless, some people will still look to move to places that are generally more affordable, where the higher interest rate doesn’t overwhelm the lower cost of living.

Q: How will interest rates and/or a recession impact new construction?

The short answer: It will slow.

Despite the incredible demand the post-pandemic buying boom created for new construction, this is the first segment of for-sale inventory to feel the effects of higher interest rates or a recession. Coupled with the high cost of materials and supply chain delays, developments that were originally slated to be for-sale properties may be converted to rentals.

Q: During the pandemic, rental rates rose sharply; by May 2022 they were 15% higher than in May 2021. Will interest rates further impact the rental market?

The short answer: Yes, but it could be positive.

Here’s why:

In the short-term, with a segment of Buyers shying away from the housing market, demand for single-family rentals continues to increase. However, with large numbers of rental units being built, and some Homeowners opting to rent out instead of sell, supply should keep rent stable and affordable.

Q: I’m regretting not selling when home prices were at their peak. Have I missed the boat?

The short answer: No. But don’t keep putting it off.

Here’s why:

While peak prices have passed, they’re still high. Nonetheless, we don’t know what a year from now will look like. If a recession comes, prices will keep dropping.

When pricing in the current market, be realistic and base your strategy on data and the advice of a seasoned Realtor. Just because your neighbor’s house sold for $100,000 over asking doesn’t mean yours will, especially now. We very likely won’t be seeing homes getting 30 offers or frenzied bidding wars anymore.

Q: As a Buyer, is there anything I can do to alleviate higher mortgage payments?

The short answer: Yes. Know and leverage your options.

A 30-year fixed rate mortgage at 6% isn’t your only choice. You can strategize to refinance in a few years. Or you can start with an adjustable-rate mortgage, then refinance to a lower rate down the line. While this comes with a risk of rates going up, it’s a good option if you plan to resell in a few years. If your purchase is long-term, plan to refinance in seven years, with the likelihood that the value of your home will have increased. Also, making a heftier down payment will lower your monthly payment.

The Bottom Line

We’re unlikely to see mortgage rates go much higher, if at all. If we head into a recession, it will likely be a mild one, which historically doesn’t affect home prices. If anything, they’ll drop — but only slightly — not significantly impacting Sellers, and making buying somewhat easier for borrowers. Additionally, rising interest rates means Buyers are delaying their plans, and the boom of new rental construction is filling their temporary need, creating a more stable rental market. Additionally, new construction that was intended to be for-sale may convert to rental opportunities as construction is delayed by rising material costs and lack of Buyers.

While conditions are not as advantageous for Buyers or Sellers as they were throughout 2021, you can still make good moves in this market.

Prices are still high, so Sellers can make an excellent return on their investment. Buyers can look forward to further price drops in the coming year, a variety of mortgage options that minimize the impact of higher rates, more homes coming up for sale, and less competition for them.

If you have any questions about Miami real estate market conditions, or would like a no-obligation consultation regarding your options, contact Monica at your convenience, any day of the week at (305) 632-7248 or at [email protected].